Cobalt and lithium are often referred to as “energy metals”. They are the primary constituents, along with graphite, of lithium-ion batteries, the fastest growing segment of the battery market. There is a lot of hype in this space, however, demand growth is strong and expected to continue. Graphite and lithium have been hot sectors, but there has been little excitement about cobalt. This metal could be next.

The Uluburun Shipwreck was discovered off the east coast of Turkey, near Kaş, in 1982. It has been dated to the late 14th Century BC. Among other cargo, it was carrying a number of ingots of cobalt blue glass. This is the earliest known use of cobalt compounds. It has been used worldwide for millennia to produce a very intense, deep blue colour. The metal itself is thought to have been discovered by Swede Georg Brandt in 1735.

Cobalt is a silvery grey hard, brittle metal that lies between iron and nickel on the periodic table, and has similar properties to those metals. It melts at 1495oC and boils at 2927oC. It oxidizes in the air to form a protective oxide film that protects it from further oxidation. It can be magnetized and reacts slowly with dilute acids.

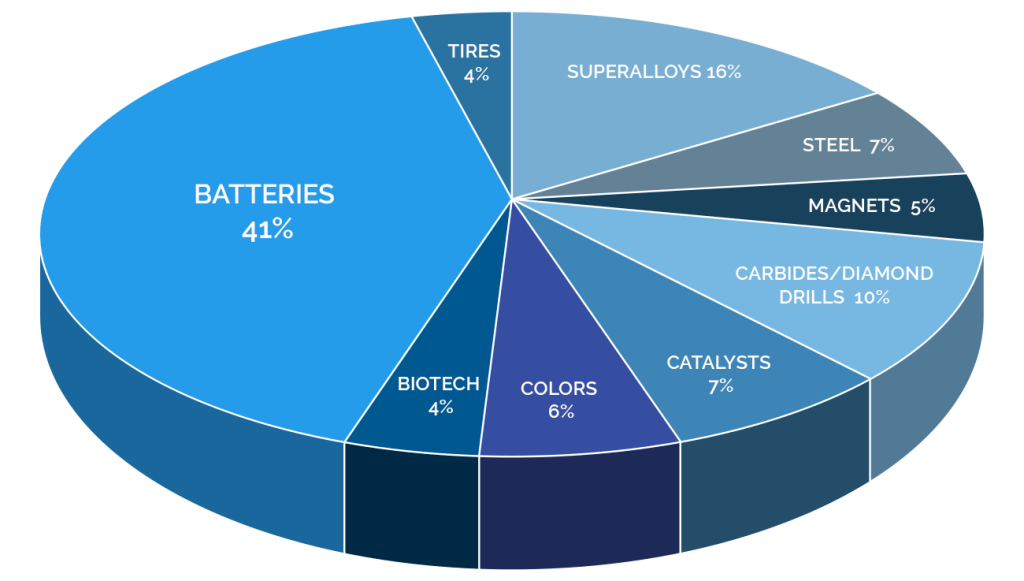

Uses of Cobalt

Cobalt was only used as a colouring agent until the beginning of the 20th century when alloys first incorporated cobalt. Today the main uses of cobalt are in “superalloys” and batteries. Numerous other uses are shown in the chart below.

Superalloys are temperature stable, mechanically strong, chemically stable and resistant to corrosion. An important use is in turbine blades, such as in jet engines. The incorporation of cobalt in a superalloy provides superior temperature stability.

The fastest-growing battery type is lithium-ion. While there are superior battery technologies under development, it is likely to be many years before they are commercialized. Lithium-ion batteries power mobile phones, laptops, and other electronic devices. Future demand growth for lithium-ion batteries is expected to be driven by electric cars and battery storage. Strong growth is expected to continue in these markets for the next few years.

There are several different types of lithium-ion batteries, not all of which use cobalt. The variables for the different battery types are cost, specific energy, specific power, safety, and lifespan.

Three of the most common types of lithium batteries do use cobalt in the cathode. The anode for each is graphite; during discharge, the lithium ions move from the anode to the cathode. Lithium Cobalt Oxide batteries are generally used in electronic devices. Lithium Nickel Manganese Cobalt Oxide (NMC) batteries are typically used in power tools and electric cars. Lithium Nickel Cobalt Aluminum Oxide (NCA) batteries are used for grid storage. NCA batteries can be used in cars but are not as safe as MNC batteries.

World Production

Cobalt most commonly occurs as a minor by-product in nickel or copper deposits. The Democratic Republic of the Congo (“DRC”) produces about half of the world’s annual production. The deposits in that country are sediment-hosted copper-cobalt deposits where the cobalt grade is far higher than in nickel deposits. For example, the small but high-grade Kalongwe project has a resource of 11Mt at 2.7% copper and 0.27% cobalt. In contrast, nickel deposits typically have a cobalt grade of less than 0.09%.

Substituion

There are many substitutes for cobalt, but performance loss is common. For example, nickel alloys can replace cobalt in turbines, as can certain ceramics.

Cobalt Price

The cobalt price is strongly influenced by the political stability of the DRC. There have been various levels of civil unrest and political instability since the 1990s. While things are relatively calm at present, we could easily see further armed uprisings. Another factor is the nickel (+copper) price. Less nickel production would mean less cobalt production.

Conclusion

It is difficult to find companies that are primarily exposed to cobalt. Nickel producers are not a good cobalt investment because their price action is closely related to nickel. However, there are a handful of companies in the junior space in Australia, Canada and elsewhere.

Stability in the DRC is key to the cobalt investment outlook. Any problems there and we could see a dramatic price spike. This would, in turn, drive up the profile of cobalt and thus lead many juniors to enter the space.

There are a number of known cobalt occurrences around the world, but in most cases, cobalt is a by-product. Nonetheless, with a sustained price rise some could look very attractive and indeed some juniors have already seen significant price moves. Cobalt is worth keeping on your watch list as any meaningful price increase will spur investment activity in the sector.